In our ever-evolving world, the need for security and peace of mind is more crucial than ever. Insurance serves as a vital safety net, shielding us from unexpected events that could disrupt our lives or threaten our financial stability. From protecting our vehicles to safeguarding our homes and valuables, the role of insurance becomes paramount as we navigate the uncertainties of life.

In South Africa, short-term insurance is a growing necessity, offering comprehensive coverage for various aspects of our daily lives. Onesuredirect stands out as a prominent short-term insurance broker, focusing on car, building, and content insurance. By understanding the specific needs of individuals and businesses, they empower clients to make informed decisions about their coverage, ensuring that they have the protection they need when it matters most. Whether it’s safeguarding your family, your assets, or your peace of mind, exploring the world of insurance reveals its undeniable power and importance.

Understanding Short-term Insurance

Short-term insurance plays a crucial role in providing financial protection against unexpected events. Unlike long-term insurance policies that cover life insurance or retirement plans, short-term insurance focuses on offering coverage for specific risks over a defined period. This can include policies that protect assets like vehicles, homes, and personal belongings from loss, damage, or theft. By having short-term insurance in place, individuals and businesses can safeguard their finances against unforeseen circumstances that could otherwise lead to significant financial hardship.

In South Africa, one of the prominent players in this space is Onesuredirect, known for its comprehensive short-term insurance offerings. They specialize in car, building, and content insurance, ensuring that clients have the appropriate coverage tailored to their needs. For example, car insurance protects against damages to vehicles caused by accidents, theft, or natural disasters, while building insurance covers potential damages to residential or commercial properties. Content insurance, on the other hand, safeguards personal belongings within a home, offering peace of mind against loss or damage.

The significance of understanding short-term insurance cannot be overstated. Properly evaluating personal or business needs can lead to informed decisions about the types of coverage required. Individuals must assess potential risks and choose policies that provide adequate protection, which is where knowledgeable brokers like Onesuredirect come into play. They guide clients through the options available, ensuring that their insurance choices align with their specific situations and provide the necessary financial safety net during challenging times.

The Importance of Car Insurance

Car insurance is a crucial aspect of owning a vehicle, as it provides financial protection in the event of accidents or damages. In South Africa, where road traffic can be unpredictable, having reliable car insurance ensures that drivers are covered for repairs, medical expenses, and any potential liability towards third parties. This safety net not only alleviates stress during emergencies but also allows individuals to drive with confidence, knowing they are protected.

Moreover, car insurance is often a legal requirement in South Africa. The Road Accident Fund mandates that drivers must have at least basic insurance coverage to protect against third-party liabilities. This requirement emphasizes the importance of securing proper coverage to avoid penalties or legal issues. By investing in car insurance, drivers are not only complying with the law but also safeguarding their financial stability should an accident occur.

In addition to mandatory coverage, choosing a comprehensive car insurance plan offers peace of mind. It covers a wider range of incidents, including theft, fire, and natural disasters. Insurance providers like Onesuredirect specialize in tailoring policies that fit individual needs, ensuring that drivers can find the right balance of coverage and affordability. Ultimately, car insurance serves as a vital shield, protecting both the driver and their financial interests on the road.

Protecting Your Home: Building and Content Insurance

Having the right building and content insurance is essential for homeowners in South Africa. This type of insurance provides financial protection against various risks such as theft, fire, and natural disasters. With increasing incidents of property-related claims, securing your home and its contents becomes a priority. By investing in comprehensive coverage, homeowners can have peace of mind, knowing they are protected against unexpected events that could lead to significant financial losses.

In addition to safeguarding the physical structure of your home, building and content insurance also covers personal belongings. This coverage is crucial for protecting valuable items like electronics, furniture, and personal effects. When purchasing insurance, it is important to ensure that the policy covers the full value of your possessions and includes a wide range of potential risks. Many insurance brokers, such as onesuredirect, offer tailored policies that cater to the unique needs of homeowners in South Africa.

Navigating the world of insurance can be overwhelming, but working with an experienced broker like onesuredirect can simplify the process. They help customers understand the various options available and guide them in selecting a policy that fits their individual requirements. With their expertise in building and content insurance, homeowners can feel confident that they are making informed decisions to protect their homes and belongings effectively.

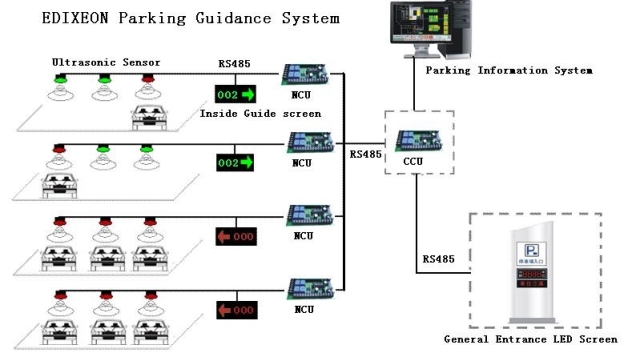

Building insurance in South Africa

Why Choose Onesure Direct?

Onesure Direct stands out in the competitive landscape of short-term insurance, especially in South Africa. With a strong focus on car, building, and content insurance, they offer tailored solutions that meet the unique needs of their clients. Their approach combines industry expertise with a commitment to customer service, ensuring that clients receive the guidance they need to make informed decisions about their insurance coverage.

Another key advantage of Onesure Direct is their user-friendly platform, which simplifies the process of obtaining insurance quotes and managing policies. Clients can easily compare coverage options and premiums, making it straightforward to find the right plan within their budget. This ease of access is crucial for customers looking to secure their assets without navigating complicated procedures.

Finally, Onesure Direct values transparency and integrity in their dealings. Their clear communication about policy terms, coverage limits, and claims processes fosters trust and peace of mind for clients. By prioritizing customer satisfaction and maintaining an honest relationship, Onesure Direct empowers individuals to feel confident in their insurance choices, knowing they have a reliable partner in safeguarding their future.