In today’s dynamic business landscape, companies constantly seek ways to optimize their assets and streamline their operations. One powerful strategy that has gained significant traction is corporate buyback, a process that allows organizations to repurchase their own outstanding shares in the open market. This strategic move not only provides companies with greater control over their stock but also presents opportunities for asset resurgence and enhanced shareholder value. Alongside this, the concept of business electronic buyback and bulk IT asset liquidation has emerged as a means for companies to efficiently manage their electronic equipment, unleashing hidden value while embracing sustainability and responsible e-waste management. In this article, we will dive into the art of business asset resurgence through corporate buybacks, exploring the potential impact, benefits, and key considerations that come with embracing this strategic approach. We will also delve into the realm of business electronic buyback and bulk IT asset liquidation, unraveling the benefits and opportunities these practices offer in the ever-evolving world of business innovation. So, let us embark on this insightful journey to unleash the power of corporate buybacks in driving business success and asset optimization.

1. The Benefits of Corporate Buybacks

In today’s competitive business landscape, corporate buybacks have emerged as a powerful tool for companies to enhance their financial standing, streamline operations, and create value for shareholders. With a focus on corporate buybacks, business electronic buybacks, and bulk IT asset liquidation, this article delves into the art of business asset resurgence. Here, we explore the numerous advantages that corporate buybacks can bring to a company.

Business formation

Firstly, corporate buybacks offer a significant avenue for companies to bolster their financial position. By repurchasing their own shares, businesses can effectively reduce the number of outstanding shares in the market. This action has the potential to increase the earnings per share (EPS) and consequently enhance the company’s financial ratios. With improved financial metrics, companies often find it easier to attract investors and secure funding for future growth and expansion.

Additionally, corporate buybacks can allow companies to express confidence in their own prospects. When a business decides to repurchase its shares, it sends a signal to the market that it believes in its ability to generate future profits and returns. This display of confidence can have a positive impact on investor sentiment, leading to increased demand for the company’s shares. As a result, the market value of the company may rise, benefiting both existing shareholders and the overall reputation of the business.

Furthermore, corporate buybacks can be an effective means of returning excess capital to shareholders. By repurchasing shares, companies can distribute surplus funds in a tax-efficient manner, providing shareholders with an attractive return on their investment. This strategy can be particularly beneficial for companies that are generating substantial cash flows but may not have immediate avenues for reinvestment. Through corporate buybacks, companies can allocate funds towards actions that directly benefit their shareholders, fostering a sense of value and loyalty among investors.

In conclusion, corporate buybacks offer companies a range of benefits, including improved financial standing, increased market confidence, and the opportunity to create value for shareholders. By understanding and harnessing the power of business asset resurgence, companies can strategically leverage corporate buybacks, business electronic buybacks, and bulk IT asset liquidation to propel their growth and success in today’s dynamic business environment.

2. Business Electronic Buyback: Streamlining Asset Management

In the fast-paced world of business, effectively managing assets is crucial for maintaining a competitive edge. One innovative solution that has gained popularity is Business Electronic Buyback. This approach allows companies to regain value from their unused or outdated electronic assets.

Corporate Buyback programs provide a streamlined process for selling bulk IT assets such as computers, servers, and other electronic devices. By partnering with a reputable provider, businesses can maximize the value of their assets while minimizing the time and effort required for asset liquidation.

With Business Electronic Buyback, companies can unlock the potential of their unused electronics. By disposing of these assets in an environmentally-friendly manner, businesses also demonstrate their commitment to sustainability.

By leveraging the power of bulk IT asset liquidation, businesses can efficiently manage their electronic assets. This approach not only helps to free up physical space but also provides an opportunity to reinvest in newer and more efficient technologies.

In summary, Business Electronic Buyback offers a practical and efficient solution for streamlining asset management. Embracing this approach allows businesses to regain value from their unused electronics, contribute to sustainability efforts, and stay competitive in today’s ever-evolving business landscape.

3. Bulk IT Asset Liquidation: Maximizing Returns

In the realm of corporate buybacks, the strategy of bulk IT asset liquidation plays a crucial role in maximizing returns for businesses. By efficiently liquidating a large number of outdated or surplus technology assets, companies can not only streamline their operations but also unlock hidden value within their IT infrastructure.

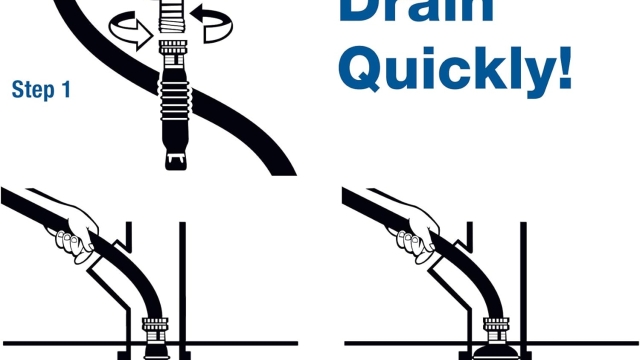

The process begins with a comprehensive assessment of the organization’s IT assets, identifying those that are no longer needed or have reached the end of their lifecycle. This could include outdated computers, servers, networking equipment, and other electronic devices. Once these assets are identified, businesses can strategically plan their liquidation, ensuring a seamless transition while optimizing their financial returns.

One of the key advantages of bulk IT asset liquidation is the ability to leverage economies of scale. By dealing with a large volume of assets, businesses have the opportunity to negotiate favorable terms with potential buyers or vendors. This can result in higher resale values for the assets, ultimately maximizing the overall return on investment.

Furthermore, by liquidating assets in bulk, businesses can also save on logistics and handling costs. Consolidating the process allows for efficient packaging, transportation, and coordination, reducing the associated expenses. This not only contributes to increasing the financial gains but also minimizes the environmental impact by promoting sustainable practices through responsible asset disposal.

In conclusion, the practice of bulk IT asset liquidation presents businesses with an effective strategy to maximize returns from their corporate buyback initiatives. By carefully assessing and streamlining their IT infrastructure, organizations can unlock hidden value, optimize financial returns, and contribute to a more sustainable business environment.