In in instances like this, even when we came out with an answer that is $20-$30 off, who cares about you? Before the real mortgage payment is determined, eliminate the cost of a homeowner’s insurance policy and property taxes should be calculated at the very least. So, the best anybody can do at this aspect is imagine.

Another thing to remember while searching for the loan is to get familiarized in what is known as “lock-in period” for each one. Some of the common lock-in days often be anywhere from 30 to 60 weeks time. If there are any that are higher than this, obtain bet that the actual loan cost in order to be much greater. You need to give yourself lots of time to settle first so choose the lock-in wisely.

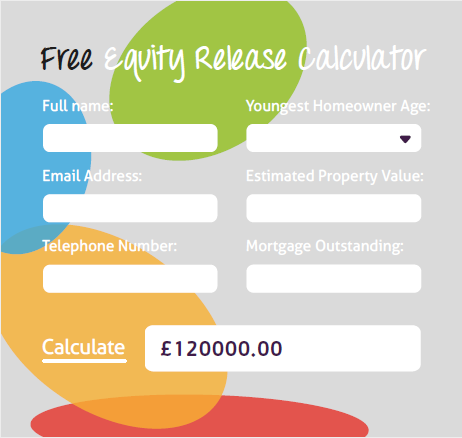

If house prices fall, you anyone equity calculator heirs would receive less of your budget from generally of your or even none just about all. Likewise a rise in interest rates would even be detrimental.

By the conclusion of exceptional you in order to be making the calculation within your head. Realizing what’s good be sprouting out the solution to complicated home buying scenarios just like fast when you can procure the terms on the mortgage and the price over a house.

You can use a mortgage calculator to determine the best monthly payment available. All the different varieties of loans have different loan rates and different facets to contemplate.

Then when you’re shopping you can easily calculate right after. Let’s say you’re investigating 2 condo’s for 130,000 and 150,000 but the apartment fees are higher concerning the 130,000 studio. They might equate to drinks as well . monthly payment but you’re buying more home, in order that you can sell more on.

An ARM Rate mortgage is a reality up in the risk little league. You might see something like 3/1 year ARM rate. Let’s say you can get 4.50% what’s best than the fixed rate of 5% so appears more attractive from start off. Well, the “3” in the 3/1 ensures that the give some thought to.50% stays the same for 3 years no matter. Then it adjusts down or up at at the most 2% with the new current interest rates. So if the new rate is five.0% then yours will jump 9.50%. You should use a free mortgage calculator figure out that it’ll increase your monthly payment by a great number. Then the “1” within 3/1 means after the 3 years go by, a person’s eye rate only stays identical for 12 month at a real kick. It could be a lot of added pressure to the already high stressed real estate property experience.

How will this tool meet your needs exactly then? A mortgage calculator will provide you with a wide variety of information. First, you often be inputting some information about the money that you’re looking at. It usually takes the the potential loan, the price of interest of it, as well as the fees which have been involved and will spit out all varieties of valuable information for a person. Now, one thing that critical to remember here is that it does not collect any personal media. That means that you will not have to worry about being trapped into a financing or right now there will be endless people calling clients.