Unlocking the Potential: Understanding the Power of 831b

Welcome to the world of 831b, where the possibilities for businesses to protect and grow their assets are endless. Captive insurance, an innovative risk management strategy, has gained prominence in recent years, and the IRS 831b tax code has provided a valuable opportunity for smaller companies to take advantage of its benefits. Designed specifically for microcaptives, these captive insurance companies with annual premiums under $2.3 million, the 831b tax election allows businesses to capitalize on the advantages previously reserved for larger organizations.

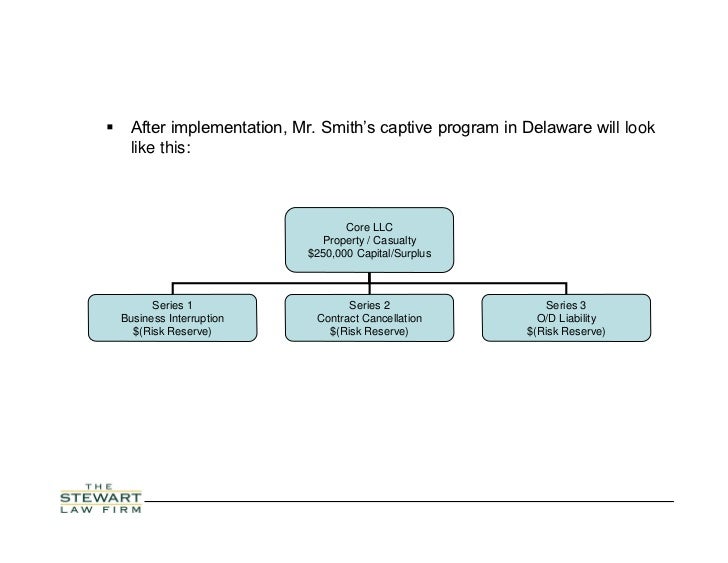

What exactly is a microcaptive, you may ask? Put simply, a microcaptive is an insurance company established by a business to cover its own risks. By creating their own dedicated insurance entity, companies can customize coverage, gain greater control over their policies, and potentially save on premiums. Captive insurance has been an established practice for decades, but the IRS 831b tax code has provided a tipping point, opening doors for smaller businesses to fully leverage the power of captives.

Irs 831b Tax Code

The benefits of utilizing an 831b captive are manifold. Firstly, it allows businesses to mitigate risks that may not be adequately covered by traditional insurance providers. By tailoring policies to their specific needs and industry risks, companies can ensure they are protected against potential dangers that may threaten their operations. Additionally, setting up a microcaptive under the 831b tax election offers potential tax advantages. With careful planning and execution, businesses can enjoy favorable tax treatment, including potential tax deductions on premiums paid to their captive insurance.

As the landscape of risk management continually evolves, the power of 831b captives becomes increasingly evident. This holistic approach empowers businesses to proactively protect their assets while potentially reaping financial benefits. In the following sections, we will delve deeper into the intricacies of the 831b tax code, exploring how it can affect businesses and uncovering key considerations to unlock the full potential of captive insurance. So, fasten your seatbelts, as we embark on a journey to unravel the power of 831b captives, revolutionizing risk management for businesses big and small.

What is 831b Captive Insurance?

Captive insurance, specifically under section 831(b) of the IRS tax code, is a form of self-insurance where businesses create their own insurance company to cover specific risks they face. This type of insurance is commonly known as "831b microcaptive" or simply "831b."

Under this arrangement, smaller businesses can form a captive insurance company to provide coverage for risks that they may find difficult or expensive to obtain through traditional insurance companies. By establishing their own insurance company, these businesses gain more control over their risk management strategies and potentially enjoy financial benefits.

The IRS 831b tax code provides a tax advantage for these captive insurance companies. The premiums paid to the captive insurer are tax-deductible for the business, and the underwriting profits of the captive can be taxed at lower rates compared to regular insurance company profits. This tax advantage incentivizes businesses to explore the captive insurance approach as a viable risk management solution.

In summary, 831b captive insurance is a type of self-insurance where businesses create their own insurance company to cover specific risks. It offers businesses greater control over their risk management strategies and potential tax advantages under the IRS tax code.

Benefits of Utilizing 831b Captive Insurance

Having a captive insurance company under the 831b tax code can offer several advantages for businesses. Here are three key benefits of implementing this strategy:

Increased Risk Management:

By forming a captive insurance company, businesses gain greater control over their risk management. Traditional insurance policies may not always cover unique or industry-specific risks adequately. With a captive insurance company, businesses can tailor coverage to suit their specific needs. This allows for a more comprehensive and targeted approach to risk mitigation, reducing potential financial losses.

Tax Efficiency:

Utilizing the 831b tax code offers tax advantages for businesses operating their own captive insurance company. Under this code, businesses can qualify for tax exemptions on their insurance underwriting profits, allowing them to retain more of their earnings. This tax efficiency can provide a significant cost-saving advantage for companies, enabling them to invest funds back into their core operations or further grow their business.

Enhanced Wealth Accumulation and Asset Protection:

A captive insurance company can also serve as a wealth accumulation and asset protection tool for businesses and their owners. By insuring risks within the captive, businesses can accumulate wealth and build a strategic reserve against potential losses. Additionally, the assets held within the captive may receive protection from creditors or other legal liabilities, providing an extra layer of asset security.

In conclusion, implementing the 831b captive insurance strategy offers businesses the benefits of increased risk management, tax efficiency, and enhanced wealth accumulation and asset protection. By navigating the opportunities provided under the IRS 831b tax code, businesses can unlock their potential and optimize their insurance coverage and financial stability.

Understanding the IRS 831b Tax Code

To fully grasp the true potential of 831b and its implications in the world of captive insurance, it is essential to have a solid understanding of the IRS 831b tax code. This tax code, also known as a microcaptive tax election, provides certain tax advantages for small insurance companies.

Under the IRS 831b tax code, a company can elect to be treated as a small insurance company for federal income tax purposes, as long as its net written premiums do not exceed $2.3 million annually. By making this election, the company can enjoy several tax benefits, such as lower tax rates on their underwriting income and the ability to deduct premiums paid to the captive.

One of the key advantages of the 831b tax code is the ability to accumulate underwriting profits on a tax-deferred basis. This means that the captive can retain these profits within the company without immediate tax consequences, allowing the funds to grow and potentially be used for future claims or investments.

It’s important to note that the IRS closely scrutinizes companies that make use of the 831b tax code, as it has been misused in the past. The IRS now requires stricter compliance and disclosure requirements to ensure that captives truly meet the criteria of insurance companies and are not being used solely for tax avoidance purposes.

Understanding the IRS 831b tax code is crucial for anyone interested in exploring the potential benefits of captive insurance. By navigating the rules and regulations associated with this tax code, businesses can unlock a powerful tool to manage risks and potentially optimize their overall financial strategies.